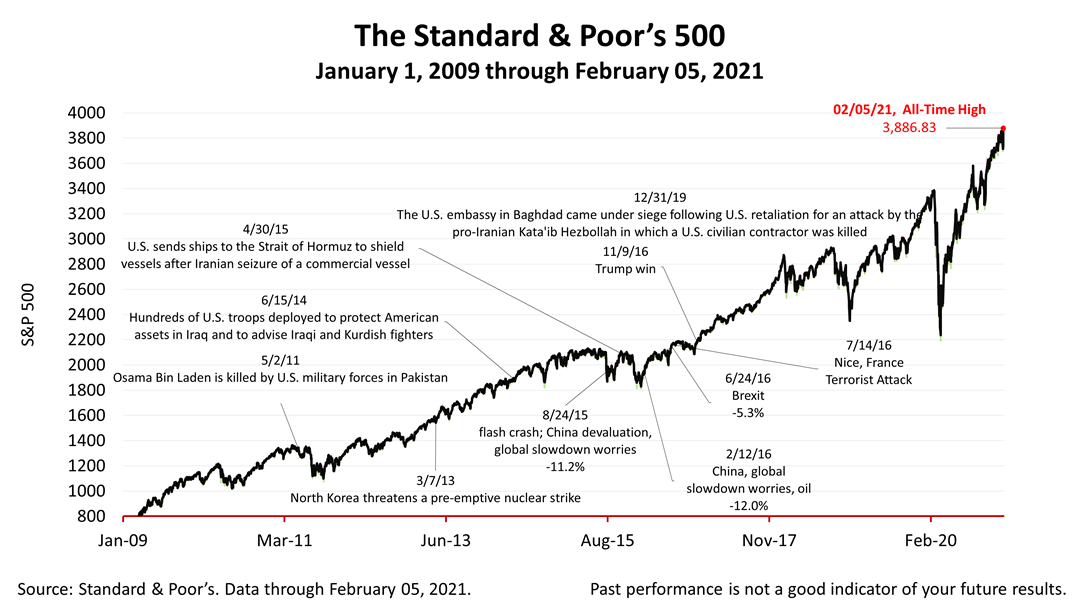

Major stock indexes closed the week at a new all-time high price! With bond yields low, not a whiff of inflation in the air, and a strong recovery expected in the second half of 2021, the Federal Reserve nonetheless remains unlikely to pull the punch bowl anytime soon. Here’s why.

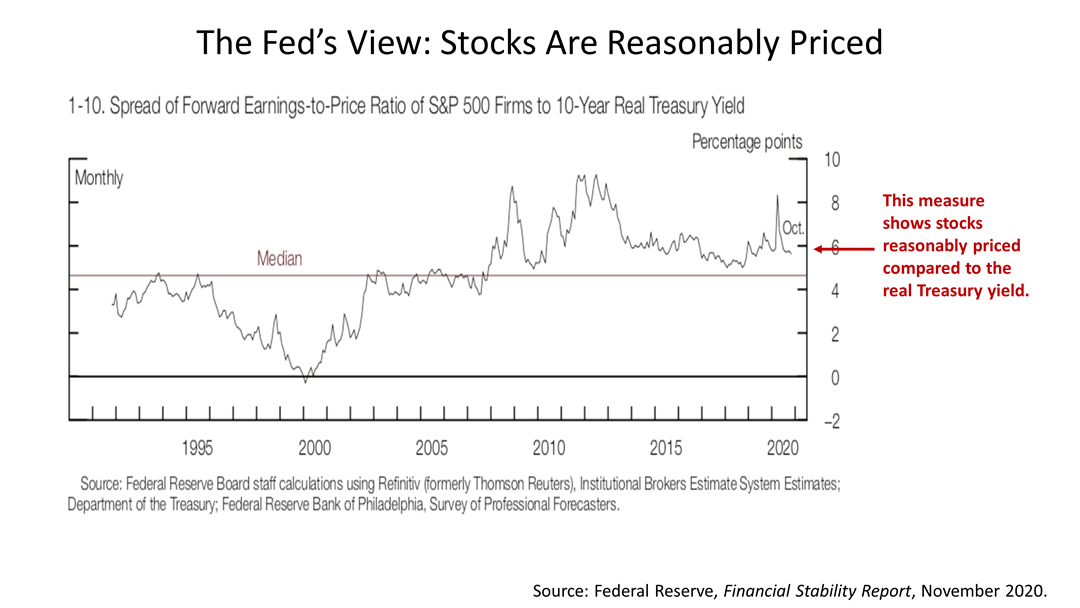

Buried in the Financial Stability Report published by the Fed twice annually every November and May since 2018 was a chart in which the Fed outlines its view of stock market valuations. This key metric compares the profit expected to be earned by the companies in the Standard & Poor’s 500 over the next 12 months versus the inflation-adjusted 10-year yield of U.S. Treasury bonds. It shows that even as the S&P 500 is breaking records stock prices are reasonable compared to bonds. Although the price-to-earnings ratio of stocks is high by historical standards, current valuations are in line with the low-yield, low-inflation of the past 13 years. Fed Chair Jerome Powell said recently that “vulnerabilities overall are moderate,” referring to this risk of an asset bubble in stocks. All this is evidence that the Fed will remain accommodative and is not going to raise interest rates anytime soon. Nor is the Fed concerned with inflation. The Fed is not planning on pulling the punch bowl from the party anytime soon.

The Standard & Poor’s 500 stock index closed Friday at an all-time high of 3,886.83. The index gained +0.39% from Thursday and is up +4.54% from last week, and +53.86% higher than the March 23rd bear market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |