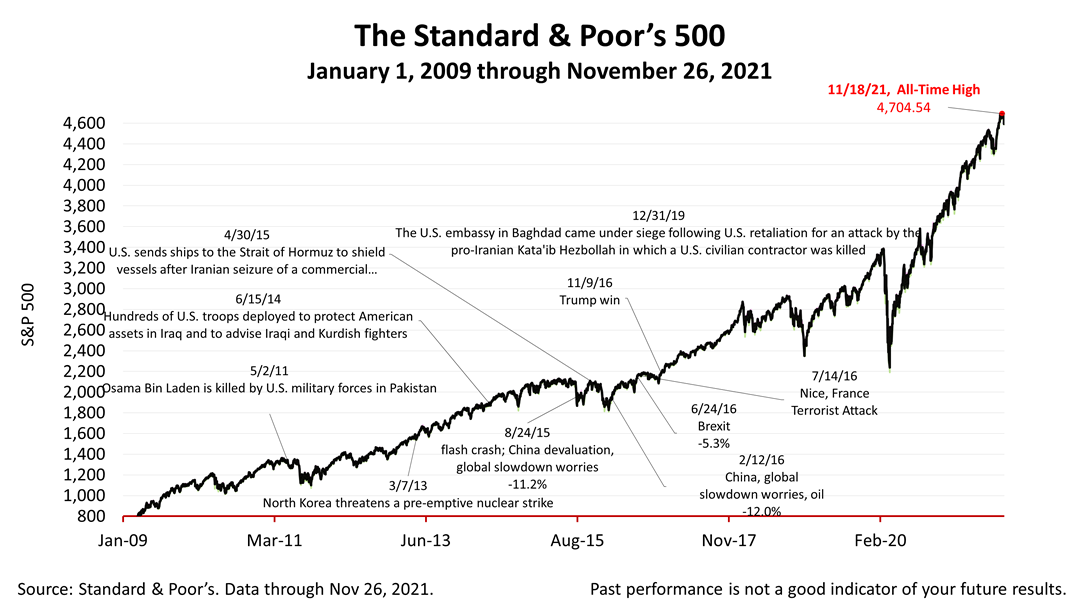

The Standard & Poor’s 500 dropped 2.3% on Friday, its worst one-day loss since February. Only five trading days earlier, the S&P 500 had closed at a record high. Friday’s abrupt reversal occurred after a handful of nations, including the United States, reinstated travel restrictions on visitors coming from southern Africa, a precaution taken to prevent the spread of a new variant of Covid-19. Whether the new variant is prevented by existing vaccines is not yet known. Friday’s loss followed a surge that began at the start of October in which the stock market soared for six weeks. The S&P 500 had closed at an all-time high on November 18. This Friday’s close was 2.2% lower than last Friday’s.

With markets closed for Thanksgiving yesterday, the Standard & Poor’s 500 stock index, closed two-hours earlier than normal on this Black Friday, at 4,594.62. Trading volume was much heavier than had been expected. The S&P 500 stock index, a barometer of U.S. strength, is up an astounding +69% from the March 23, 2020, Covid bear-market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |