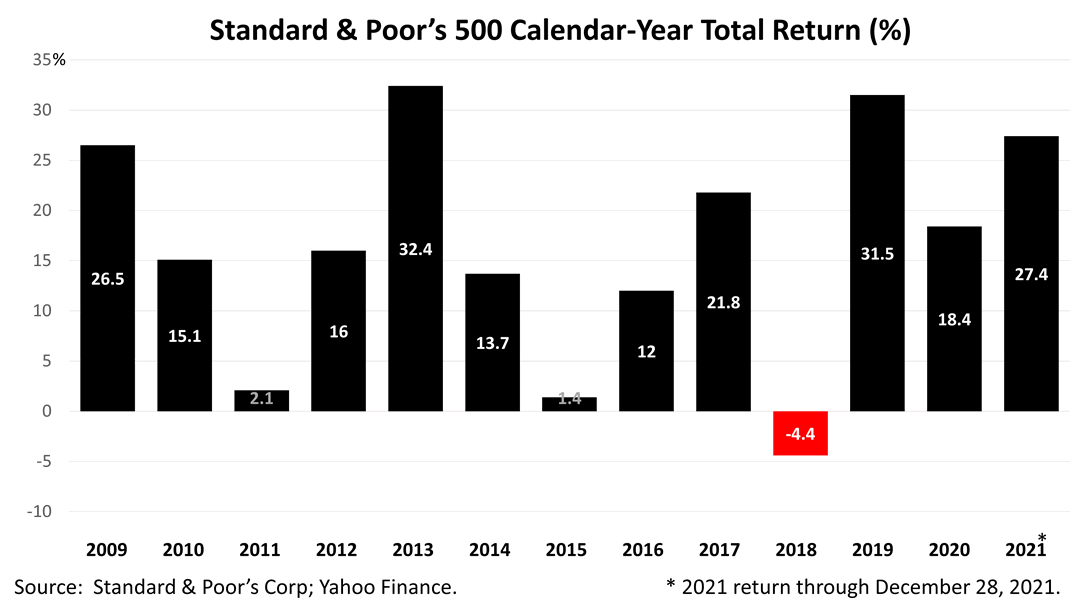

The stock market is surprising everyone with its pandemic-defying performance in 2021. With just two trading days left until the end of the year, the Standard & Poor’s 500 stock market index, with dividends reinvested, has returned a spectacular 27.4% in 2021! Who could have predicted it amid the pandemic? Not Wall Street’s best minds!

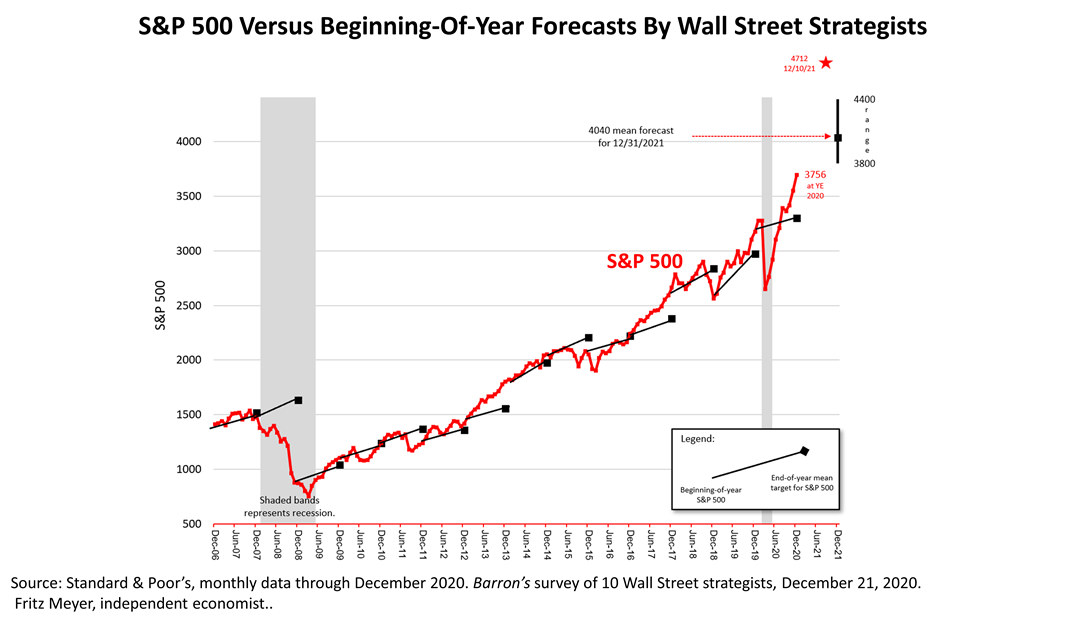

On December 21, 2020, Barron’s published an article in which they asked 10 leading Wall Street strategists to predict the closing price of the S&P 500 on December 31, 2021. The S&P 500 closed 2020 at 3756 and the mean forecast of the 10 strategists was for the S&P 500 to close 2021 at 4040, about an 8% gain. The strategists’ consensus is not even close to the 27.4% gained through the end of today, December 28, 2021. In this chart, each black line represents the consensus forecast of the 10 strategists published in Barron’s annually since 2008. If the Wall Street strategists’ annual forecasts had been correct, the dots would fall right on the red line representing the S&P 500, but they usually are not even close.

Although Wall Street strategists’ forecasts have been consistently unreliable since 2008, 2021 illustrates just how wrong the largest brokerage firms can be. It’s reason No. 9 to trust our advice: We are independent of the Wall Street sales machine. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |