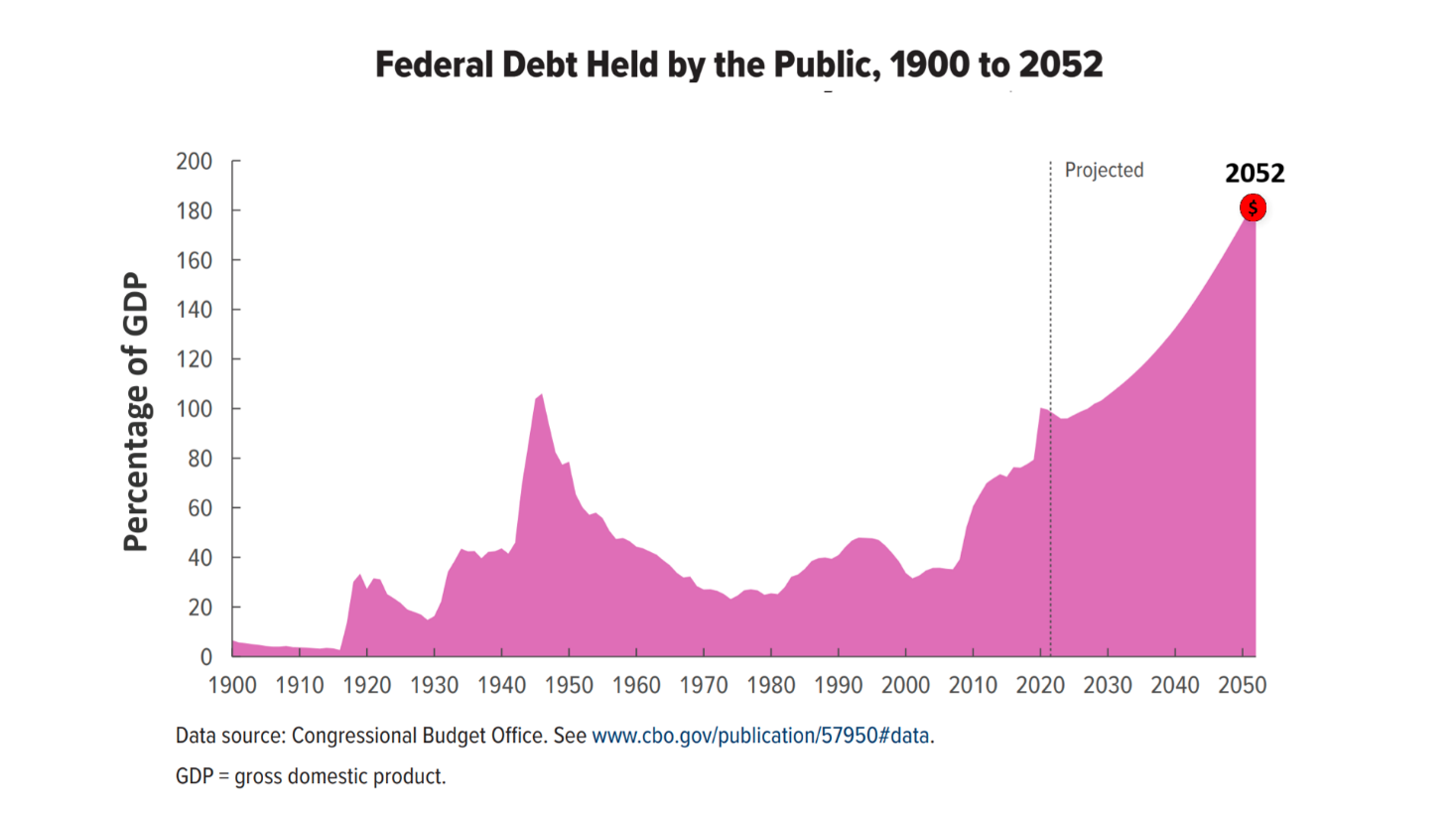

The Federal debt is projected to increase to 110% of the size of the economy in 2032 — higher than it’s ever been. ​In the following two decades through 2052, growing deficits are projected to push the federal debt much higher still, to nearly twice the size of gross domestic product.​ ​Based on these projections from the nonpartisan Congressional Budget Office, it’s fair to say the interest owed on the federal debt skyrockets and becomes unsustainable by 2052. ​ No one can predict the future, but it seems likely the federal government will need to hike income tax rates in the U.S. in the years ahead to avert going over a fiscal cliff.​ As a result, converting assets to Roth IRAs is a compelling retirement tax move to consider in 2023. Converting assets from traditional IRAs to Roth IRA accounts could allow you to pay income tax at today’s presumably lower rates instead of at higher tax rates likely to apply in the years ahead, and it would also set you up for tax-free withdrawals late in life.

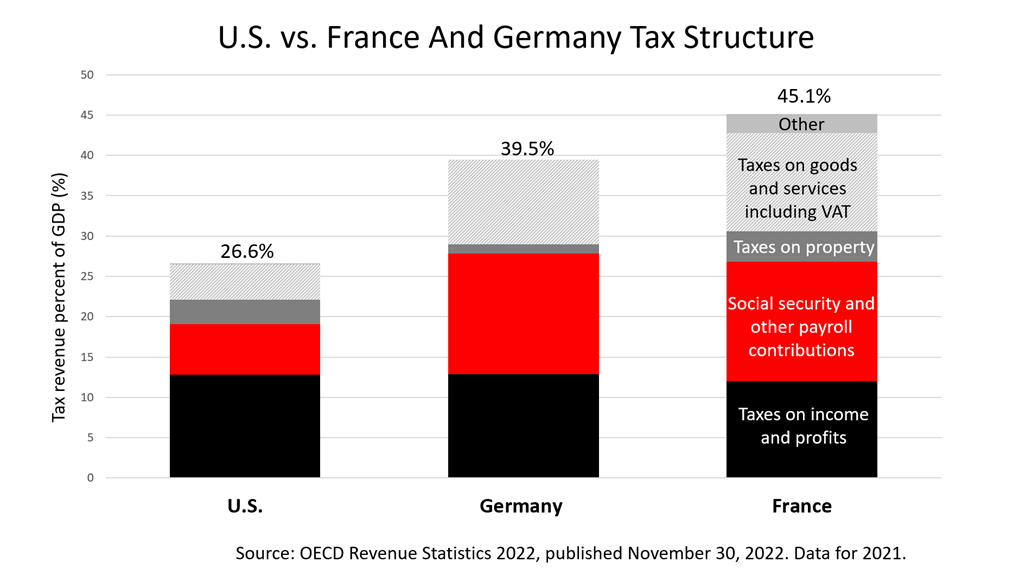

Tax rates in the U.S. are low relative to other large, developed economies, like Germany and France, according to the Organization for Economic Cooperation and Development, an alliance of advanced economies. ​If you believe a tax rate hike is likely, it’s wise to consider converting assets now held in traditional IRAs to Roth IRAs. Conversions from traditional IRAs to Roth IRAs involve selling assets in a traditional IRA and paying income tax on the withdrawn amount and then investing the proceeds in a Roth IRA, which is not subject to income tax annually or upon withdrawal. ​ Traditional IRAs are not taxed until you withdraw the money in retirement. At age 73, you are required to start taking distributions, with minimum required distributions set by actuarial estimates of how many years you are expected to live. In contrast, Roth IRAs have no required minimum distributions. Thus, they can continue to benefit from tax-free compounded growth after you’re 73. In addition, unlike traditional IRAs, withdrawals from Roth IRAs are tax-free. Plus, your children and other beneficiaries of Roth IRAs have the option to spread their inheritance in equal installments over as long as 10 years, giving the inherited Roth IRA additional time to compound tax-free. With stock prices and the economy much stronger than expected for many months, this is a good time to consider converting assets to Roth IRAs accounts. But don’t wait too long. Planning to take a distribution from a traditional IRA, pay tax on the income withdrawn, and use the amount withdrawn to fund a Roth IRA is a fairly straightforward process, but it can easily take two or three weeks. So doing before the 2023 tax year ends — the busiest time of the year for tax and financial advisors — is prudent. The process involves calculating the right amount to convert without pushing you into a higher tax bracket and paperwork must be completed and submitted to your IRA custodian. Plus, the new Roth IRA account will need to specify your beneficiaries. Keep in mind, to qualify for a tax-free withdrawal, you must own a Roth IRA five years and the withdrawal must be made on or after you turn age 59½, or in the event of a qualifying disability, or in the event of your death, or if you are using the proceeds to buy a home for the first time. State income tax treatment of Roth IRAs also must be planned. A Roth conversion may not be right for everyone. A number of factors should be considered before converting, including whether paying taxes on the withdrawal today outweighs the benefit of income tax-free distributions in the future. This is an area of financial planning where consulting with a tax and legal advisor about your personal situation can pay off. You may decide to begin a multi-year strategic plan to lock in tax-free income for retirement. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |