Have you logged in to your Social Security account? Creating an online account at SSA.gov is an important first step in understanding your retirement income situation. However, only about 60 million of the 160 million individuals in the U.S. labor force who have Social Security accounts have created a way to access the Social Security Administration’s website. At SSA.gov/my account, it’s easy to create an account, even if you have no patience for online machinations. Logging in allows you to find out how much you’ve paid into Social Security in your lifetime and so far, this year. These are basic facts about your retirement that you really ought to know about, particularly since you’re paying for the government to provide this service for you.

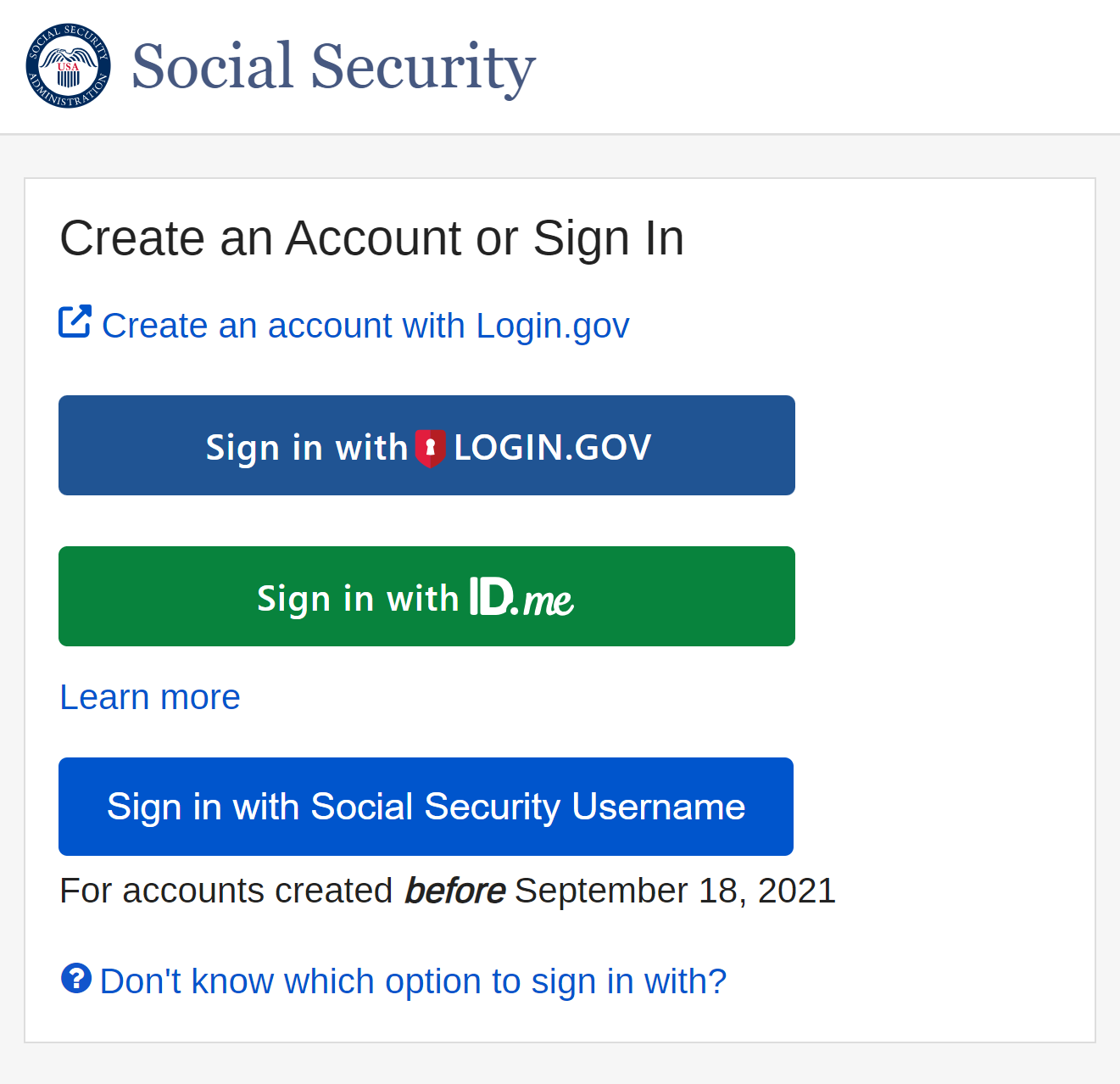

You can choose from three methods to create a username and password to log in to your account. For instance, logging in at using Login.gov is simple: check a box to accept the terms of use and verify your email address by clicking a link that is emailed to you. Fill in your social security number, address, and phone number. Then verify your contact information by responding to an email and text message. For an added layer of security, download an authentication application to your smartphone using the iPhone app store or Google Play. Google’s authenticator app is free for both iPhone and Android devices. It generates secure, six-digit codes that you use to sign into your account. Once you’ve set up your account, you can download your Social Security benefit statement and your Primary Insurance Amount (PIA). Social Security benefits are calculated based on your highest 35 calendar years of earned income. Your PIA is the benefit you would receive if you elected to begin receiving retirement benefits at your normal retirement age, which is generally between age 65 and 67 for most individuals. On the home page of your personal social security account, you can see your statement.

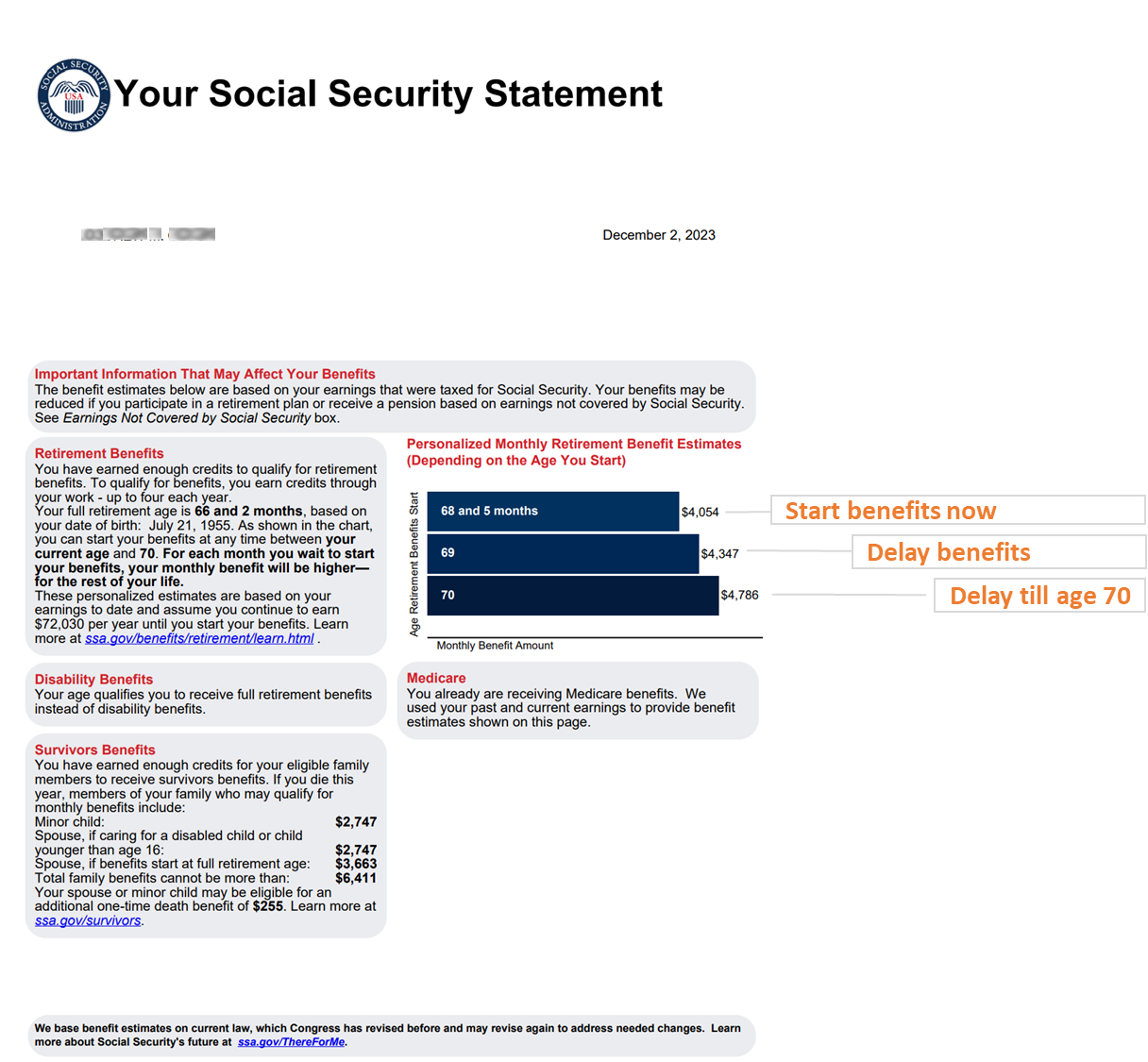

The blue bar chart shows the benefit you’d get if you started collecting retirement benefits immediately. The bottom bar shows your benefit amount if you delay taking benefits as long as possible by waiting until age 70. The middle bar illustrates waiting to take benefits in between now and age 70.

Page 2 of your social security statement includes a table summarizing your earnings history. For a full earnings history report, scroll down on your personal social security account home page. Next week, we’ll show how a pre-retiree can use SSA.gov to determine the optimal time to begin retirement benefits depending on your current income, personal earnings history, including a calculation that includes your spouse’s earnings history and current income. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |