2023 is now financial history and it will forever be recalled as a year that faked out investors. At the end of 2022, the usual warning signs of recession were flashing red, and the stock market was priced only slightly higher than the post-pandemic bear market low. Defying all expectations, stock prices closed 2023 with a 12-month gain of 24%. Not in recent memory has an outlook so bleak been followed by such strong stock appreciation and economic growth. A year ago, a 10-year U.S. Treasury bond yielded less than a three-month Treasury bill. An inverted yield curve — when bond investors are not paid a premium longer-term bonds than 90-day day T bills, is a signal a business slowdown and recession are ahead. In addition, one year ago, the U.S. Index of Leading Economic Indicators was signaling a recession was likely within months. The LEI is comprised of 10 components and slumped months ahead of every recession in modern history (except the pandemic recession). What caused the great fake out of 2023 is debatable, but the best explanation is that investors fell victim to the “money illusion,” a known issue afflicting mass financial psychology. Financial psychology defines the money illusion as valuing money in nominal terms — paying no attention to after-inflation dollars. The money illusion infiltrates the American consumer mindset after a period of high inflation. Consumers and investors soured on the economic outlook because prices on many items have risen sharply. We all lived through this post-pandemic period when supply chain problems, massive government stimulus, and higher gasoline prices made inflation soar to a 40-year high. However, the gloomy outlook was inherently flawed. The money illusion made it easy to overlook the real cost of groceries after-inflation and wage hikes, which is what really matters. People notice higher prices but gains in wages after inflation often go unrecognized in a period of disinflation. To be clear, right after a high-inflation mentality infiltrates the mass financial psyche, it takes time for the American financial mindset to adjust to a low-inflation mindset in which consumer buying power is not being decimated and showing real growth. The Atlanta and New York Federal Reserve branch algorithms predict growth of the U.S. economy in the fourth quarter of 2023, which will be released in a month, will come in at respectively 2.4% and 2.3%. That would be stronger then expected. Growth in 2024 is poised to be stronger than expected as the influence of the money illusion will continue to slowly be assimilated into the American financial psyche.

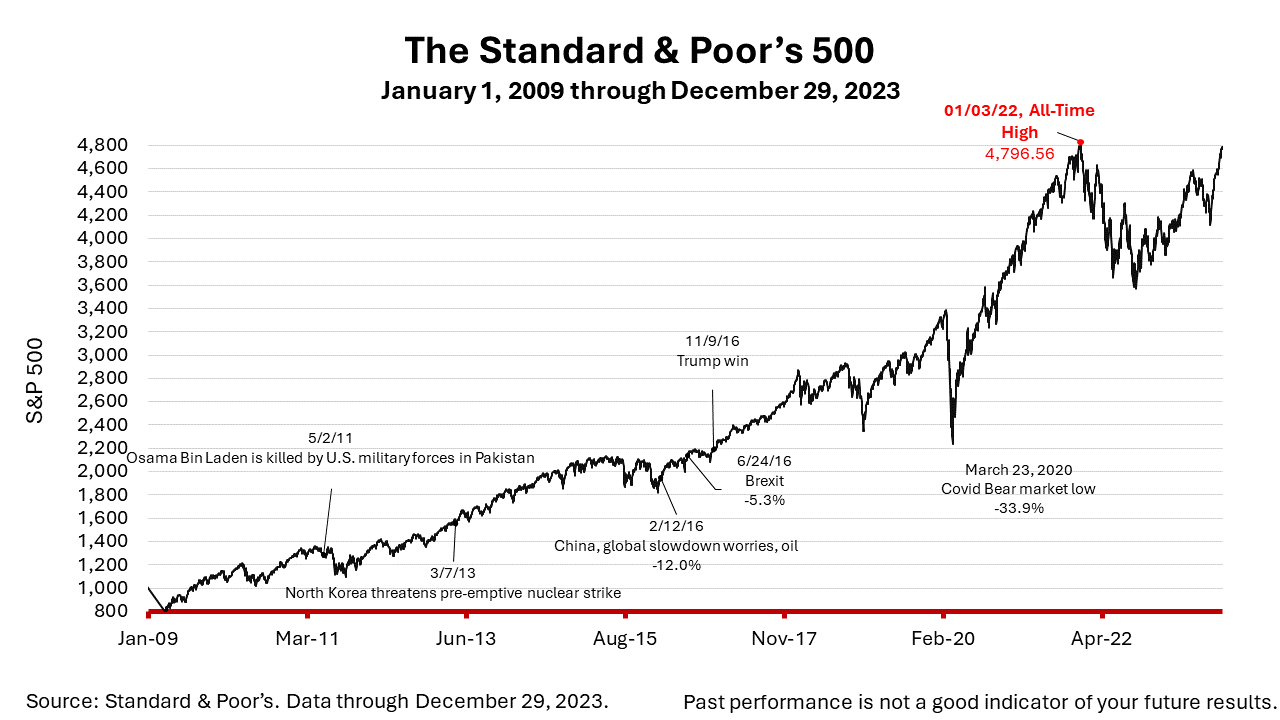

The Standard & Poor’s 500 stock index closed Friday at 4769.83, down -0.28% from Thursday. It gained +0.32% from a week ago, making it the ninth consecutive week of gains, which Reuters reports is longest weekly winning streak in 20 years. The index is up +113.19% from the March 23, 2020, bear market low. and down -0.56% from its January 3, 2022, all-time high. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. ​​​​​​​​ Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |